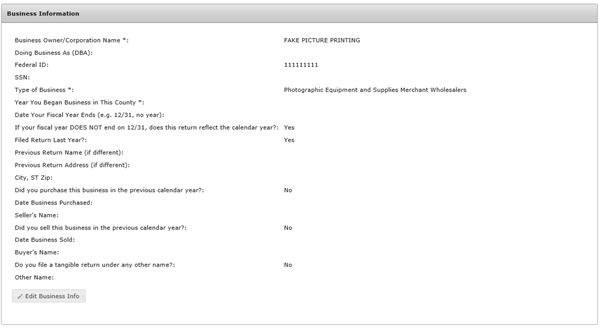

Business Information

The business information fields contain details about the business operations within Polk County. The business information is pre-populated with the data from the Property Appraiser's system. You do not need to enter anything in these fields unless the information is incorrect, incomplete, or has changed. Click the "Edit Business Info" button to update the Business Information.

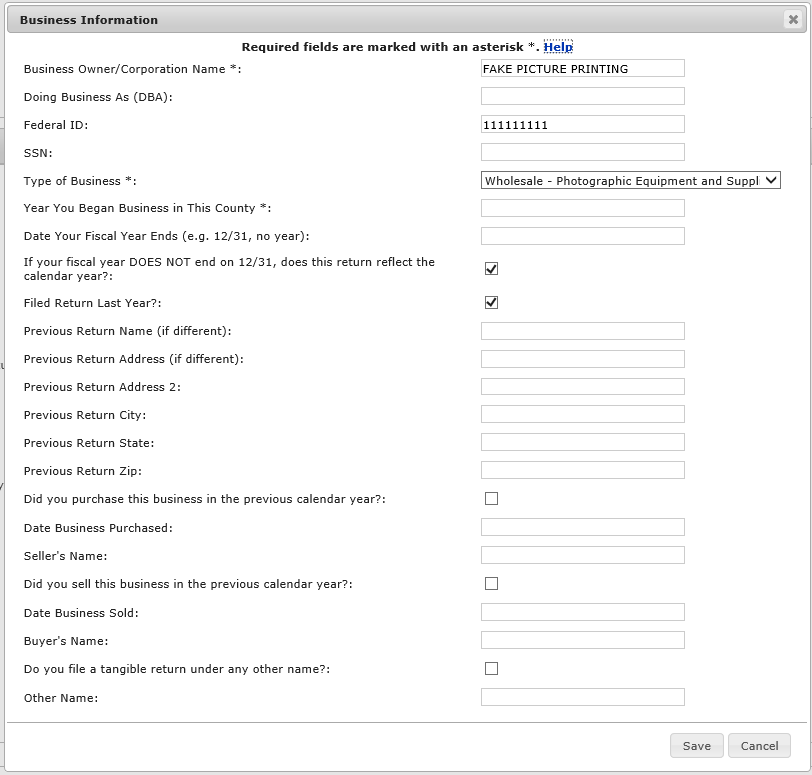

NOTE: If you need to update the Business Information click the "Edit Business Info" button, the dialog below will open. Update the data, and click save.

|

Business Owner/Corporation Name * |

This is the business owner or corporation name. |

|

Doing Business As (DBA) |

This is the business name--the name on the sign / over the door. This is not required for Mobile Home Accounts or if Businesses Owner/Corporation Name is the same as the business name. |

|

Federal ID (EIN) |

A nine-digit number assigned to a business for tax reporting purposes. |

|

SSN |

The tax identification number for an individual is his/her Social Security Number. In the case of a sole proprietorship, a Social Security Number can be used as the business tax identification number. |

|

Type of Business* |

Choose the description from the drop down menu that best describes the type of business. |

|

Year You Began Business in This County* |

The 4-digit year that the business began operation in Polk County, Florida. |

|

Date Your Fiscal Year Ends (e.g. 12/31, no year) |

Enter the month and date that signifies the ending of your fiscal year. For example, If your fiscal year ends on December 31st, enter 12/31. NOTE: Fiscal year denotes a 12-month period over which a company budgets its spending. A fiscal year does not always begin in January and end in December; it may run over any period of 12 months. |

|

If your fiscal year DOES Not end on 12/31, does this return reflect the calendar year? |

If your fiscal year does not end with the calendar year on December 31 and you are reporting based on the fiscal year, be sure to UNCHECK this box. |

|

Filed Return Last Year |

If a TPP return was filed with Polk County for this business last year, check the box. |

|

Previous Return Name (if different) |

Only applies if you filed a return for the same location or assets under a different name last year. If this does not apply to you, leave this fields blank. |

|

Previous Return Address (if different)Previous Return Address2 Previous Return City Previous Return State Previous Return Zip |

Only applies if you filed a return for the same location or assets under a different address last year. If this does not apply to you, leave this fields blank. |

|

Did you purchase this business in the previous calendar year? |

If you purchased the business last year, check the box. If the box is checked you must also enter the date you purchased the business (Date Business Purchased) and the name of the person who sold you the business (Seller's Name). |

|

Date Business Purchased |

If you purchased the business last year enter the date you purchased the business. |

|

Seller's Name |

If you purchased the business last year enter the name of the person who sold you the business. |

|

Did you sell this business in the previous calendar year? |

If you sold the business last year, check the box. If the box is checked, you must also enter the date you sold the business (Date Business Sold) and who you sold the business to (Buyer's Name). |

|

Date Business Sold |

If you sold the business last year enter the date you sold the business. |

|

Buyer's Name |

If you sold the business last year enter the name of the person to whom you sold the business. |

|

Do you file a tangible return under any other name? |

If you own another business or file a return under any other name check the box. If the box is checked, you must also list the name under which you are filing another return. |

|

Other Name |

If you own another business or file a return under any other name, list the name under which you are filing another return. |