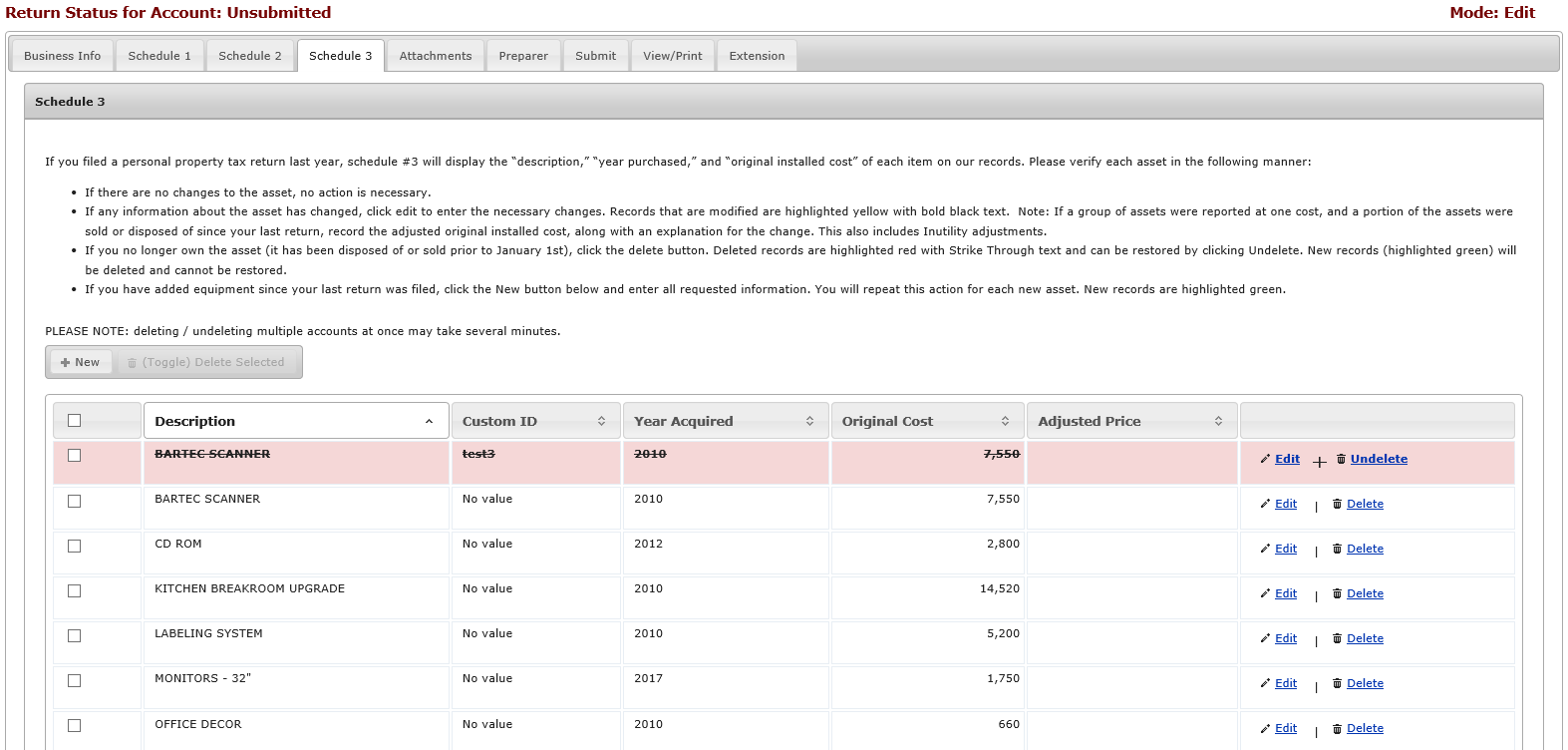

Schedule 3 Tab

If you filed a personal property tax return last year, schedule #3 will display the description, year purchased, and original installed cost of each item on our records. Please verify each asset in the following manner:

• If there are no changes to the asset, no action is necessary

• If any information about the asset has changed, click the Edit button to edit an item.

• If you no longer own the asset (it has been disposed of or sold prior to January 1st), click the Delete button to delete an item.

• If you have added equipment since your last return was filed, click the New button to add a new item.

In the screen shot above, you will see the Delete Selected (Toggle) button is grayed out. This is because there are no items chosen to delete. If you had checked any items in the delete box, this button would have been available to use.

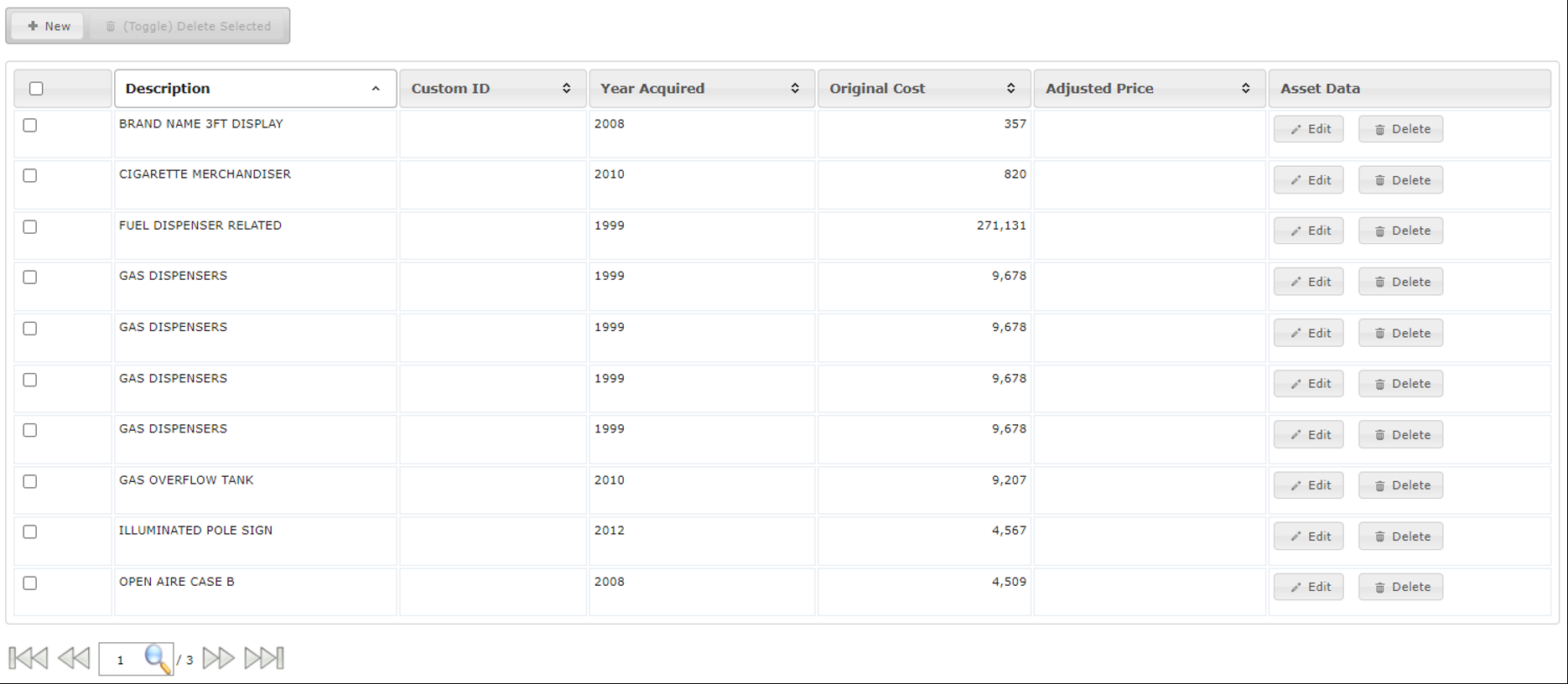

You may also sort the columns using the arrows in the column heading. The default sort is alphabetical by description, however, you may sort the other columns in order to find the necessary asset(s) to make your changes.

You can navigate the asset(s) by using the icons at the bottom of the page for first page, previous page, next page and last page. You can also type the page number into the text box to go directly to the necessary page.

NOTE: Rows for new items in the return will be highlighted green.