Excel Import Template Instructions

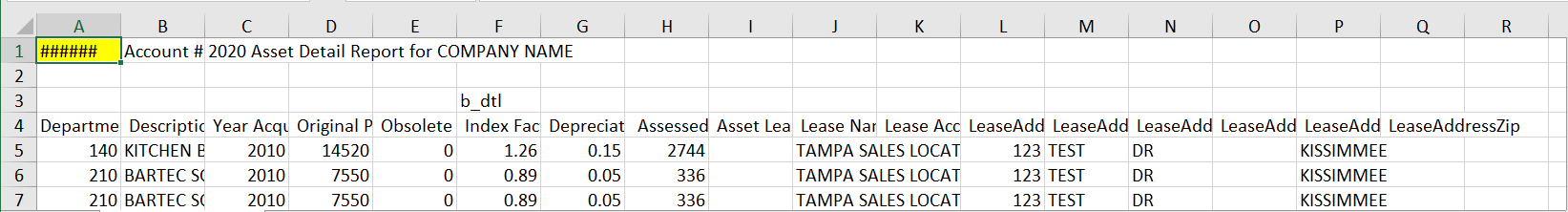

The same list of business assets that can be written on a hard-copy Tangible Return or entered via the Tangible Online Filing Application cam be attached under the attachments tab. The data in the Excel Template should be formated as shown below.

You can find a excel template on our website Excel Import Template.

Column Name |

Size / Characters |

Description |

|

Account # |

10 |

The Tangible Account Number |

|

Department Code |

4 |

The Department Codes you can find them here: TPP Department Codes and Factors (polkpa.org) |

|

Description |

50 |

A brief description of the leased item. For example, "Cannon 3200G Copier" or "Kubota Fork Lift". |

|

Year Acquired |

4 |

The 4-digit year that the asset was originally purchased or the 4-digit year that the lease began. |

|

Original Price |

12 |

The original purchase price of the asset |

|

Obsolete Percentage |

6 |

The obsolete percentage of the asset |

|

Index Factor |

9 |

The index factor of the asset you can find them here: TPP Department Codes and Factors (polkpa.org) |

|

Depreciation Percentage |

5 |

Percentage of Depreciation |

|

Assessed Value |

12 |

The Assessed value of the asset |

|

Asset Lease ID |

30 |

Your internal asset/leased item identification number |

|

Lease Name |

50 |

Lessee Name |

|

Lease Acct |

30 |

Lessee of Lessor Account |

|

LeaseAddressStreetNumber |

10 |

Lessee or Lessor Street Number |

|

LeaseAddressStreetName |

50 |

Lessee or Lessor Street Name |

|

LeaseAddressStreetSuffix |

8 |

Lessee or Lessor Street Suffix |

|

LeaseAddressStreetDirection |

2 |

Lessee or Lessor Street Direction |

|

LeaseAddressCity |

50 |

Lessee or Lessor City |

|

LeaseAddressZip |

10 |

Lessee or Lessor Zip |