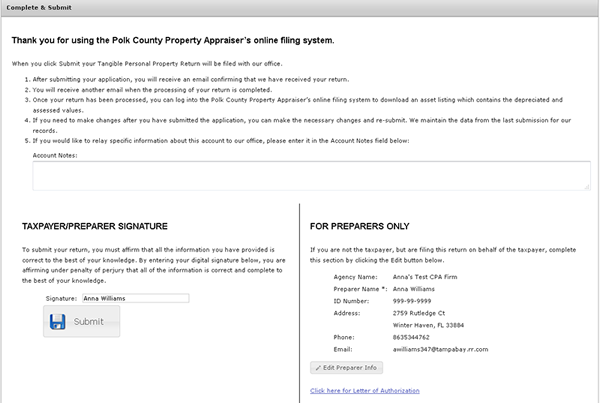

Submit Tab

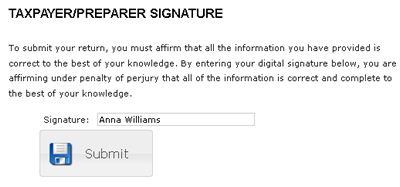

When you have completed and verified all necessary fields under the 'Business Info', 'Schedule 1', 'Schedule 2', and 'Schedule 3', or the Attachments Tab, you can submit the return by typing in your name and clicking the Submit button.

|

|

Account Notes: if you would like to relay specific information about this account to our office, please enter it in the Account Notes field.

For Preparers Only: If you are a professional preparer, click 'Edit Preparer Info' and complete the preparer fields before submitting the return. Note: If you are preparing a return for a client you must have a letter of authorization on file with the Polk County Property Appraisers office. See Import Letter of Authorization (LOA) for additional information. Taxpayer/Preparer Signature: To submit the return, sign the return by typing your name in the 'Signature' box and clicking the 'Submit' button. This field will hold a maximum of 50 characters, including spaces

|

When you click Submit, your Tangible Personal Property Return will be filed with our office.

1.After submitting your application, you will receive an email confirming that we have received your return.

2.You will receive another email when the processing of your return is completed.

3.Once your return has been processed, you can log into the Polk County Property Appraiser's Tangible Online Filing application to download an asset listing which contains the depreciated and assessed values.

4.If you need to make changes after you have submitted the application, you can make the necessary changes and re-submit. We maintain the data from the last submission for our records.

5.A copy of the return will be emailed to the contact email on file as well as to the preparer email (if a preparer is added on the submit tab)